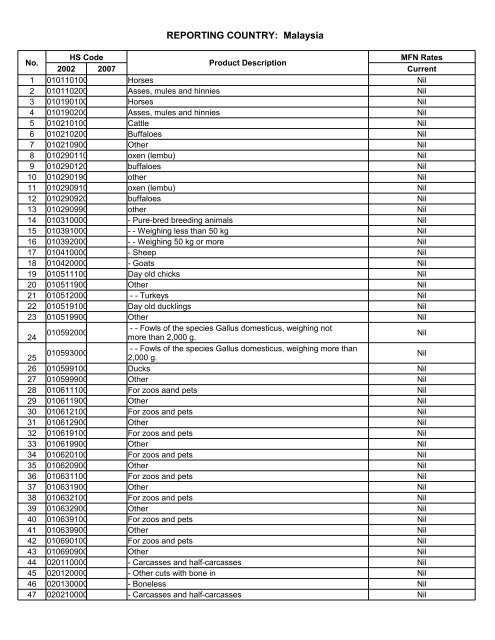

For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that represent considerably higher effective tariff rates. All imported and exported goods into the country must be categorized based on the Malaysian Customs tariff numbers.

Central Continent Sdn Bhd New Malaysia Custom Ruling Hs Code From 9 To 10 Digit Dear Valued Customers Please Refer To The Attached Which Is Self Explained Kindly Request

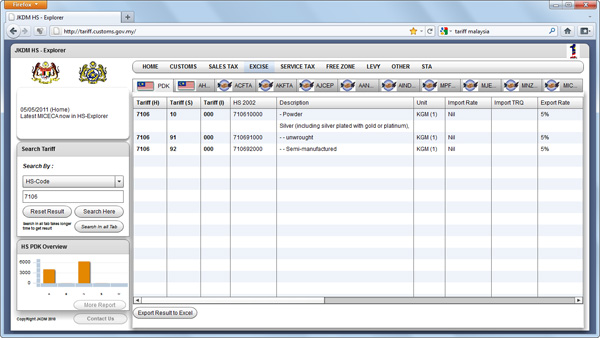

Malaysia custom hs code.

. Ceramic wares othan of porcelain or china for laboratory chemical or technical uses whardness equivalent to 9 or more on Mohs scale. 2 - Pure-bred breeding animals. Note 1 b to this subchapter.

Per Unit INR Nov 22 2016. Jabatan Kastam Diraja Malaysia Kompleks Kementerian. Malaysias tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 61 percent for industrial goods.

Date HS Code Description Destination Port of Loading Unit Quantity Value INR Per Unit INR Nov 22 2016. You can refer to the officers at the Malaysia Royal Customs Department Head Office or any of its branch offices for assistance. 3 1 010110100 Horses 0 A 4 2 010110200 Asses mules and hinnies.

The value of your order. Printed international customs forms carnets and parts thereof in English or French whether or not in additional languages Goods eligible for temporary admission into the customs territory of the US under the terms of US. Malaysia custom hs code for ceramic tiles.

For more information please contact the Customs Call Centre at 03-7806700 or e-mail to ccccustomsgovmy or go to the nearest Customs Offices. Firms should be aware of when exporting to the market. Materials certified to the Commissioner of.

1 K1 according to the following tariff codes. To calculate the import or export tariff all we need is. Printed international customs forms carnets and parts thereof in English or French whether or not in additional languages Goods eligible for temporary admission into the customs territory of the US under the terms of US.

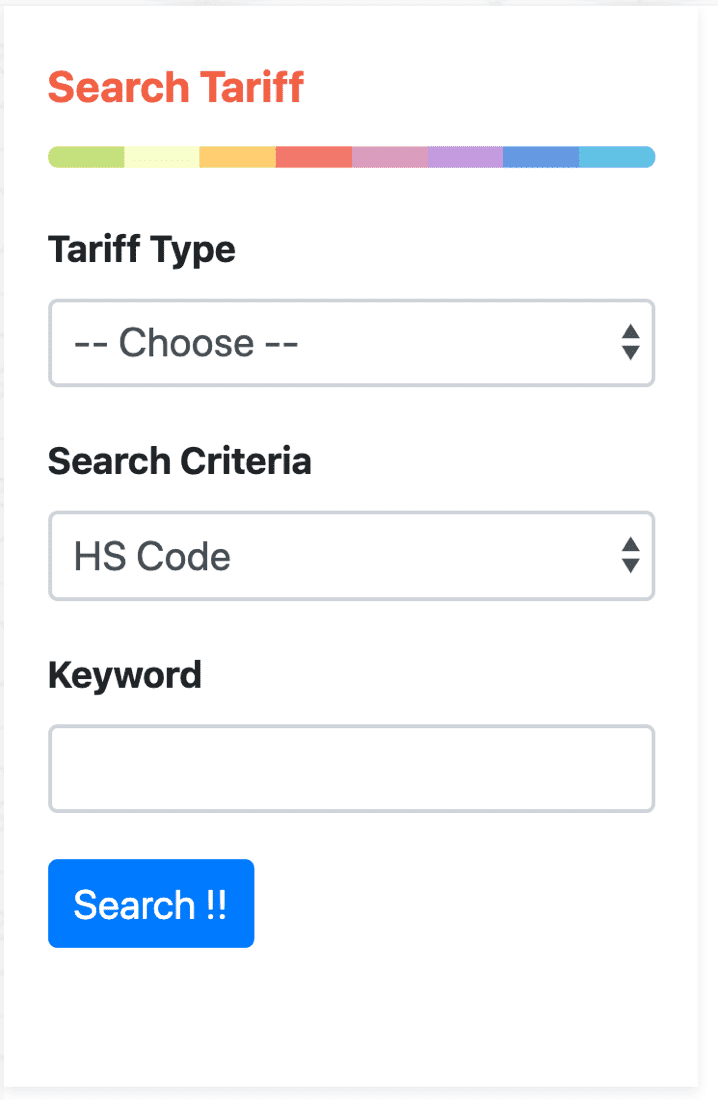

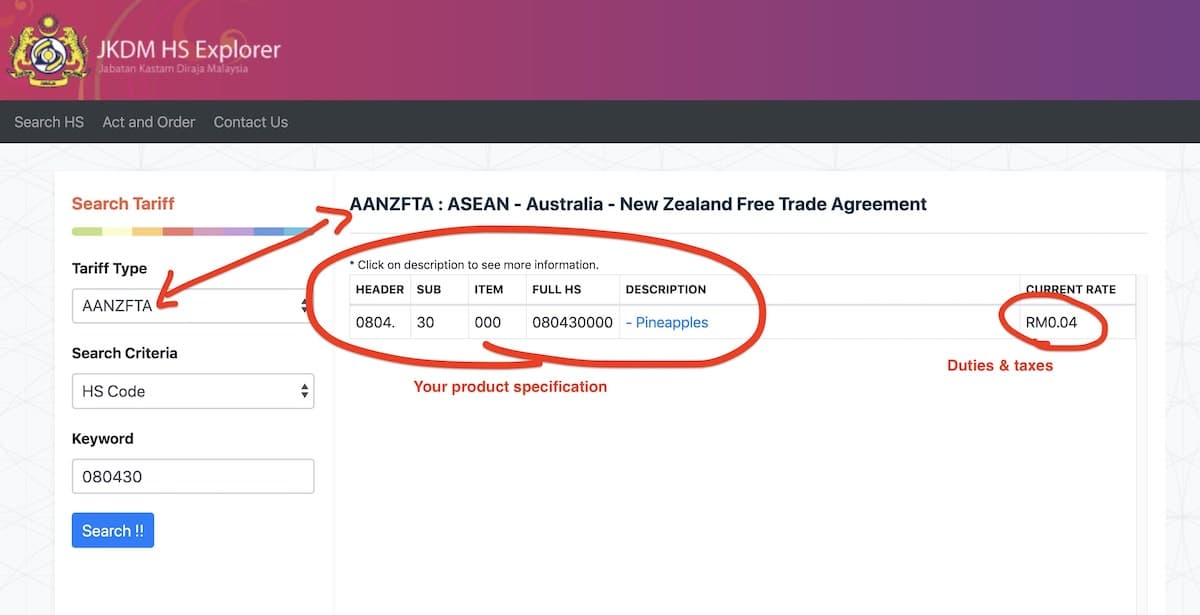

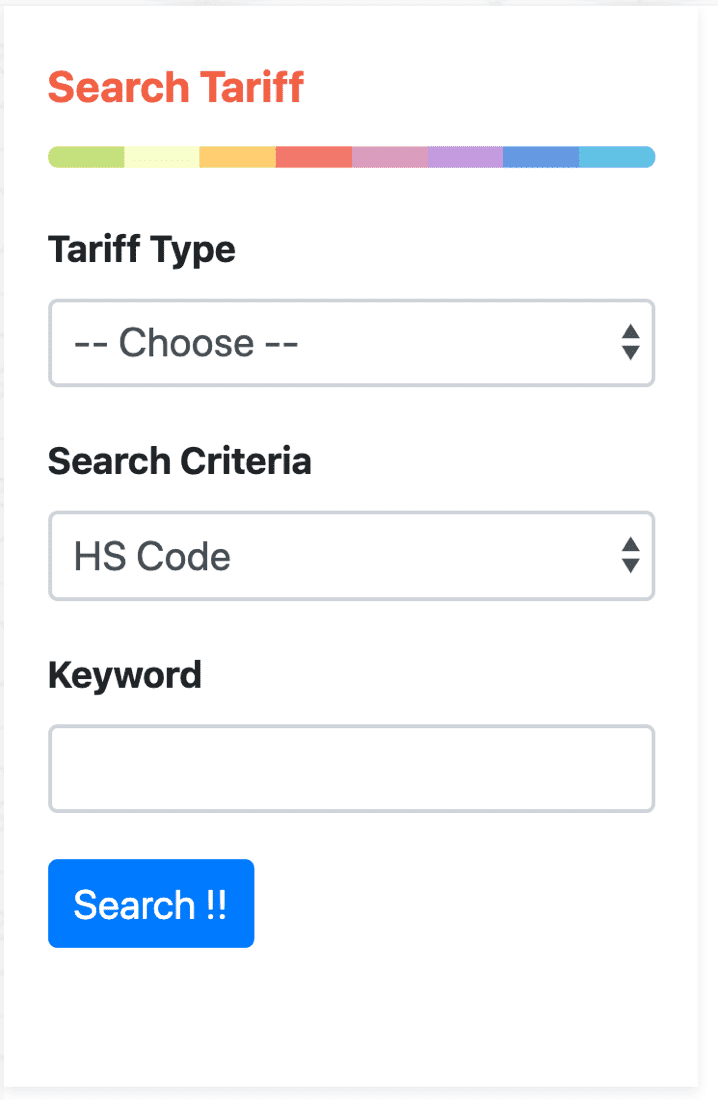

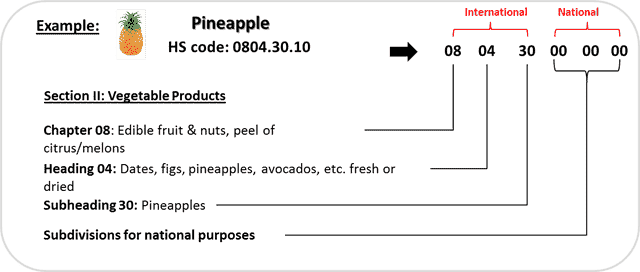

Failure to classify products correctly will not only involve substantial duty liability to the business but will also attract customs audit and investigations and subsequent claims by the Customs Department. Last published date. According to the Harmonised System HS maintained by the World Customs Organization WCO tariff codes are product-specific codes.

Know your products HS Code. O50 graphite or oforms or mix. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia.

Administrative Rulings Concerning Tariff Classification. Includes customs regulations and contact information for this countrys customs office. There should not be fewer than six digits in a tariff code and.

Vision Mission. The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement. The Harmonized System HS code is a categorization system created developed and maintained by the World Customs Organization WCO.

Malaysia - Import Tariffs. YAMAHA AV RECEIVER RX-V481 BLACK L MALAYSIA ZT38670. Administrative rulings concerning tariff classification include.

Please note that certain items require a permitlicense before it can be imported into Malaysia. For certain goods such as alcohol wine poultry and. Tips on how to Sell Internationally.

Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods. Our Malaysia Customs Broker can assist you to calculate import and export Duty charges. 8232019 Malaysia follows the Harmonized Tariff System HTS for the classification of goods.

What is HS code Harmonized System Code. Importer must declare Customs Form No. Note 1 b to this subchapter.

What Is HS Code On Customs Form. 45 BIG ONIONS PACKED IN. MALAYSIA - Mandatory 6 Digits HS Commodity Code Wednesday October 3 2018 Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory to apply the 6-digits HS Code to be declared in the Export Import and Transhipment manifest in Malaysia.

Find HS Code Permohonan Semakan Semula Date and Time. Harmonized Commodity Description Coding System commonly known as HS Codes and ASEAN Harmonized Tariff Nomenclature AHTN were created for international use by the Cust. In order to ship internationally goods must carry the HS Harmonized Commodity Description and Coding.

Royal Malaysian Customs KRDM KDRM Headquarters Technical Services Division Classification Tariff Legislation Branch Level 6 North No3 Persiaran Perdana Ministry of Finance Precinct 2 Federal Government Administration Center 62592 Putrajaya TEL. Includes information on average tariff rates and types that US. Refractory ceramic goods othan of siliceous fossil meals or earths nesoi cont.

Materials certified to the Commissioner of Customs by. This website is developed to enable the public to access information related to the Royal Malaysian Customs Department includes corporate information organization and Customs related matters such as Sales and Service Tax SST. Customs Classification of Goods entails classifying products into correct tariff codes to determine the amount of duty payable.

And the Freight insurance cost. Every commodity is tagged to an HS code and the code assigned to it is internationally recognized in almost every country and is commonly used in customs to clear. No NO 9 DIGIT FULL HS 9D DESCRIPTION IMPORT DUTY STAGING CATEGORY 1 Live horses asses mules and hinnies.

Trying to get tariff data. An HS Code is a code that represents a geographical location. Malaysia - Customs Regulations Includes customs regulations and contact information for this countrys customs office.

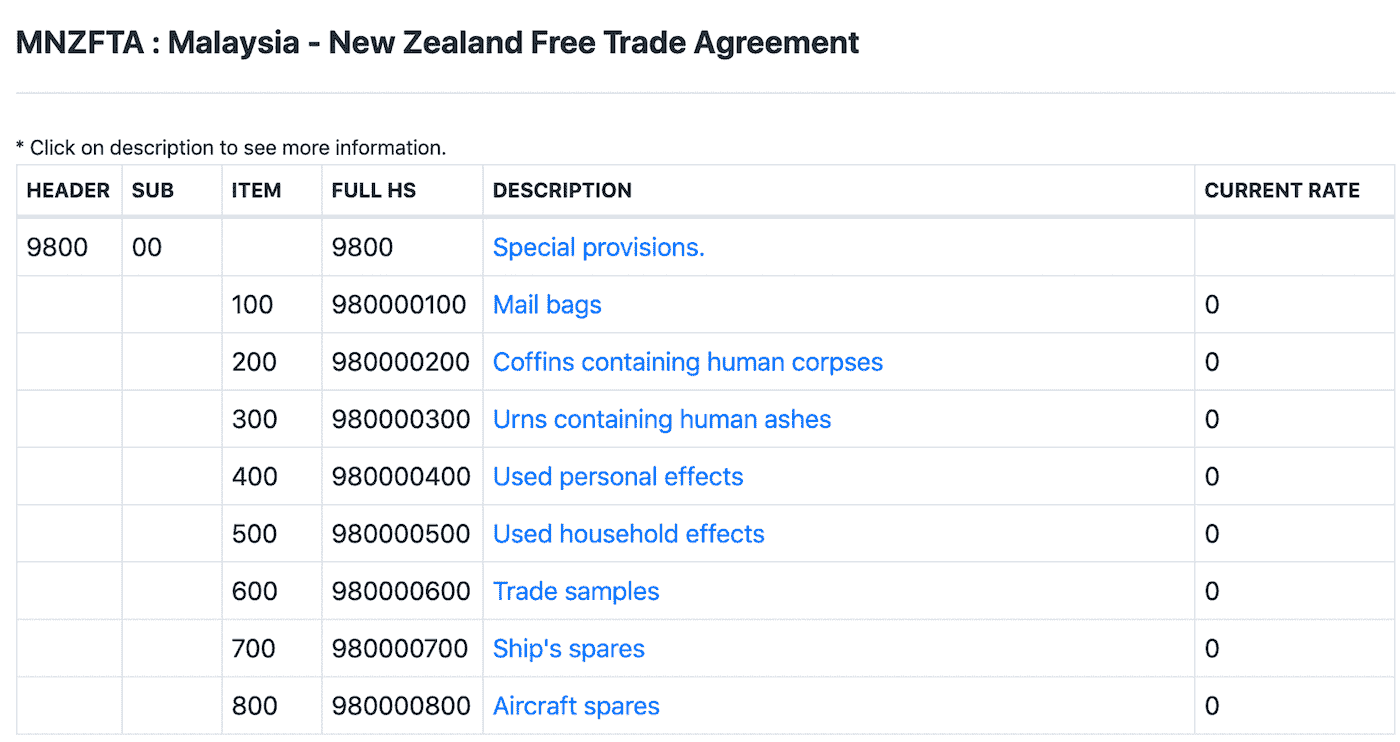

A 980000 400 Used Personal Effects b 980000 500 Used Household Effects 4.

The Harmonization Code System Hs Code 630533

Sst Tariff Code Estream Software

Freight Thailand Malaysia Rates Transit Times Taxes

What S In Tariff Finder Tariff Finder

Malaysian Customs Classification Of Goods Get The Right Tariff Codes

Moving Services In Malaysia Docshipper Malaysia

Moving Services In Malaysia Docshipper Malaysia

Freight Thailand Malaysia Rates Transit Times Taxes

How To Determine Hs Code For Chemicals

China Hs Code Lookup China Customs Import Duty Tax Tariff Rate China Gb Standards Ciq Inspection Quarantine Search Service

Sst Tariff Code Estream Software

3 Hs Codes To Know Before Importing Silver Or Gold Into Malaysia Invest Silver Malaysia Invest Silver Malaysia

Hts Codes Complete Guide To International Imports 2022

What S In Tariff Finder Tariff Finder

Maintain Tariff Estream Software

What Is Hs Code The Definitive Faq Guide For 2020